The Story:

When REV Federal Credit Union set out to redefine its brand, I had the opportunity to be part of a small, passionate team leading the charge. Together, we built a brand that felt fresh, forward-thinking, and deeply connected to the community we serve.

When REV Federal Credit Union set out to redefine its brand, I had the opportunity to be part of a small, passionate team leading the charge. Together, we built a brand that felt fresh, forward-thinking, and deeply connected to the community we serve.

Where We Started:

REV’s original brand reflected a traditional credit union aesthetic — muted colors, outdated imagery, and a conservative look and feel. It lacked energy, modern appeal, and emotional connection. We saw an opportunity to reimagine the brand from the ground up and reposition REV as a bold, community-focused financial institution that could grow with the next generation of members.

REV’s original brand reflected a traditional credit union aesthetic — muted colors, outdated imagery, and a conservative look and feel. It lacked energy, modern appeal, and emotional connection. We saw an opportunity to reimagine the brand from the ground up and reposition REV as a bold, community-focused financial institution that could grow with the next generation of members.

Phase 1: Concepting & Inspiration

Sourced creative inspiration: looking to both likely and unlikely places to spark new ideas.

Explored color theory: to build a strong visual foundation that felt bold, approachable, and modern.

Narrowed down names and logo designs: focusing on designs that captured the spirit of the evolving brand.

Defined naming criteria: aiming for a short, memorable name utilizing “color pops” to create immediate recognition.

Phase 2: Identity Creation

Crafted a cohesive brand identity: selecting colors, fonts, and design elements that would shape the REV brand.

Developed the brand vision: defining who REV would be in the market and how we would connect with members.

(Example: REV’s identity centered around meeting people where they are — approachable, innovative, and rooted in community.)

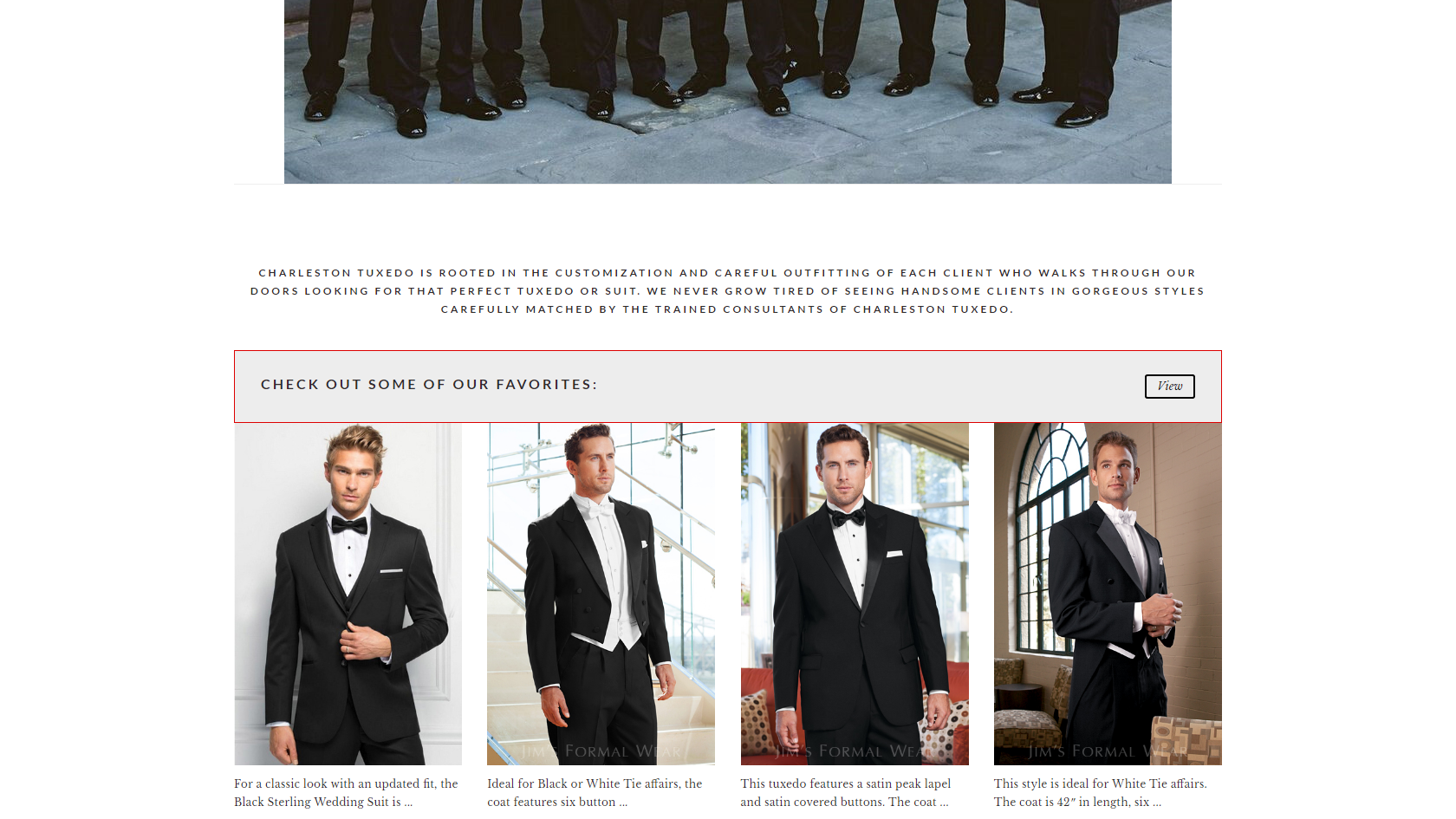

Phase 3: Brand Execution & Rollout

Collaborated across departments: ensuring brand consistency across all touchpoints, from digital experiences to community sponsorships.

Advocated for authenticity: aligning all branding efforts with REV’s mission to "grow with purpose" and drive real community impact.

Phase 4: Market Expansion Strategy

As the brand matured, REV began expanding beyond its original footprint — including multiple acquisitions and entry into new markets like North Carolina. Maintaining brand consistency while authentically introducing ourselves to new communities was key.

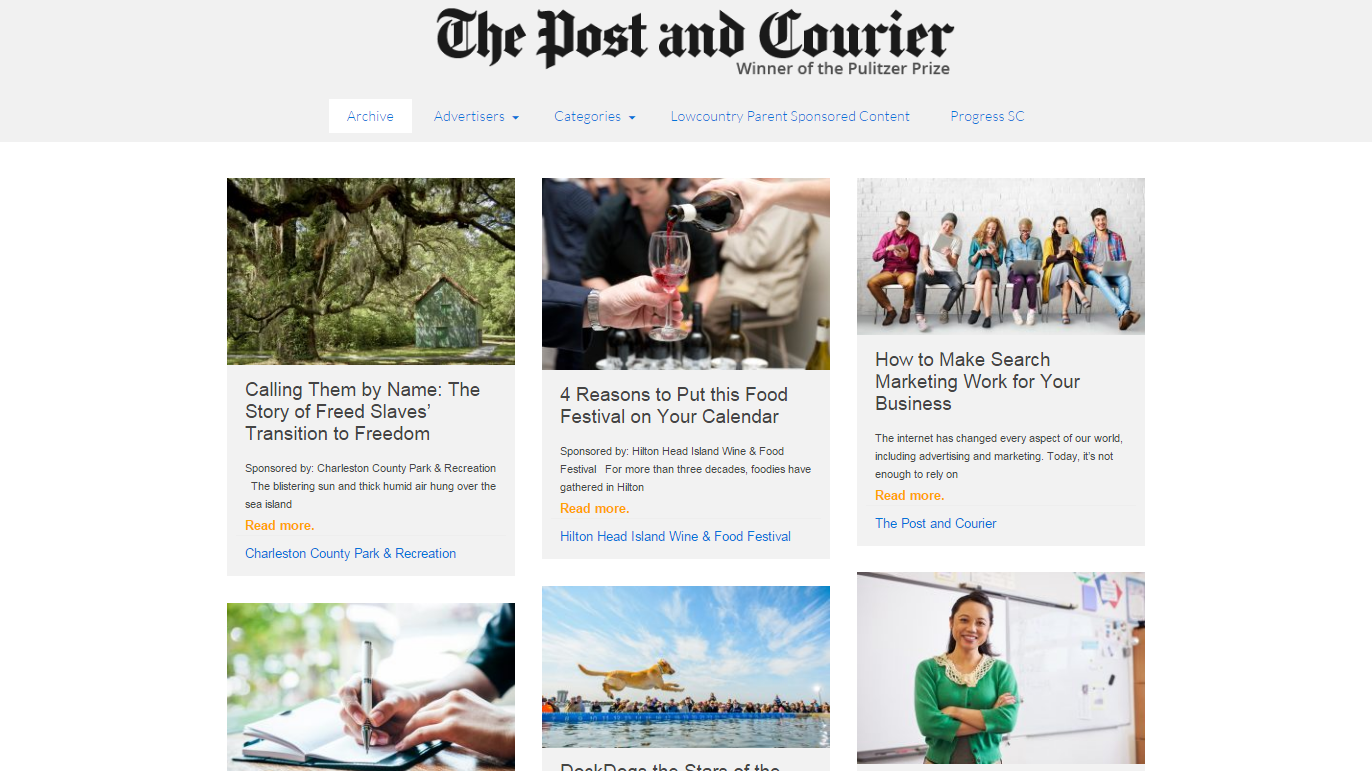

Launched strategic communications: keeping employees, members, and key community leaders informed and engaged.

Prioritized community giveback: organizing local volunteer events and initiatives to build trust and visibility.

Invested in local sponsorships: partnering with concerts, sporting events, and festivals to establish a strong local presence.

Promoted financial products and services: through targeted advertising across print, digital, and grassroots marketing channels.

Highlights:

Brand launch successfully completed in 2020

Expanded into two new markets

Completed Digital Transformation Roadmap (including card, core, and digital banking conversions)

147 charities supported / 13,000+ volunteer hours / $582K donated / 6,000+ students impacted *Figures as of end of 2024

9 awards received, including Charleston Metro Chamber of Commerce Business of the Year

Asset Growth: $646M (2019) to $1.11B (2024)